How to Build Wealth Using a 1031 Exchange

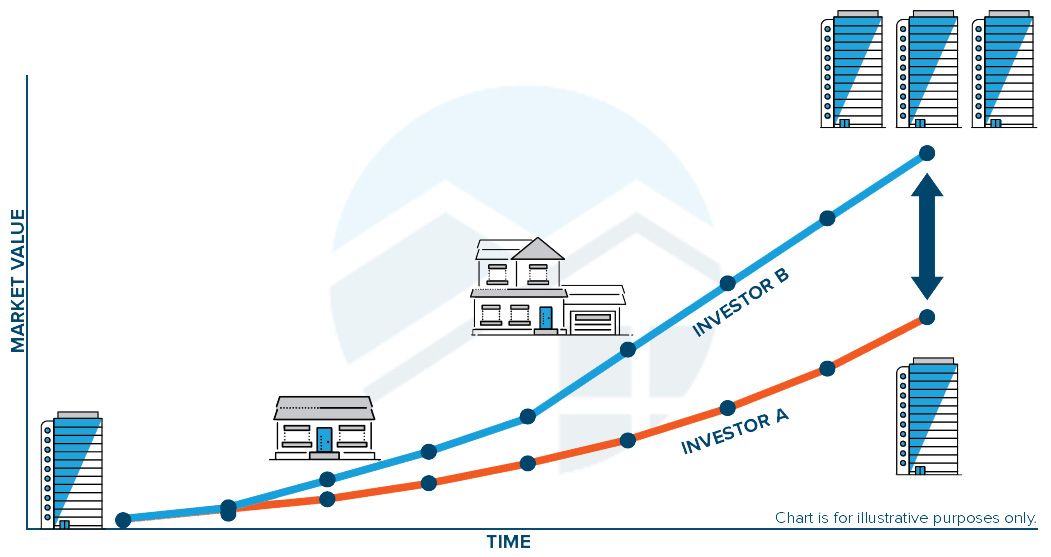

Investing in real property is a proven strategy to build wealth. In the above example, Investor A purchased and held an investment property that increased in value over time. Investor B purchased a similar investment property at the same time as Investor A. However, Investor B traded up to more valuable properties several times over the same time period. Investor B used 1031 exchanges each time to defer capital gains taxes from the sale of the relinquished property so that the entire proceeds from the sale could be rolled into the purchase of a replacement property. After several years, Investor A’s investment property did increase in value; however, Investor B, who upgraded several times to increasingly more valuable properties, holds a more diversified and valuable real property portfolio.

How a 1031 exchange works

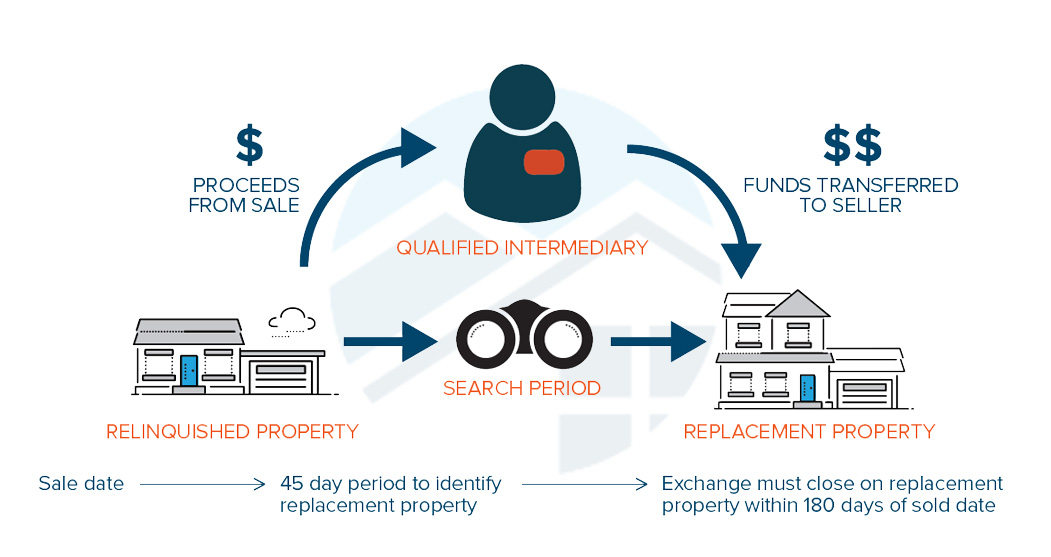

A 1031 exchange allows an owner of an investment property to build wealth by exchanging that property for another investment property (or properties) and deferring the capital gains tax on the relinquished property. This strategy allows the investor to roll the entire proceeds from the sale of the relinquished property into the replacement property.

Types of 1031 exchanges

- DELAYED EXCHANGE The most common tax-planning strategy, a delayed exchange occurs when there is a delay between the sale of the relinquished property and the purchase of the replacement property. The delayed exchange allows investors up to 180 days to purchase a replacement property after the relinquished property is sold.

- REVERSE EXCHANGE A reverse exchange is when the replacement property is identified before the sale of the relinquished property. The reverse exchange must be completed within 180 days.

- THIRD-PARTY BUYER EXCHANGES Parents 1031 investment property into new residence for kids / kids help pay and join on title.

- SPLIT EXCHANGES Two or more separate living units on same property - primary residence vs. rental units.

- MIXED-USE PROPERTY Same living unit occupied 2 out of last 5 years as principal residence and rented out rest of time.

- TENANTS-IN-COMMON SALES/EXCHANGES Multiple family members / friends in investment group hui - some sell / some 1031.

- RELATED-PARTY EXCHANGES How to make related parties “unrelated” to avoid restrictions on related party 1031s.

Glossary

- ACCOMMODATOR OR QUALIFIED INTERMEDIARY A person or entity who assists the exchanger in a tax-deferred exchange by holding the exchange proceeds, and acting as the principal in the sale of the relinquished property and the purchase of the replacement property. The accommodator cannot be the taxpayer, a related party or an agent of the taxpayer.

- ADJUSTED BASIS Usually, the purchase price, plus capital improvements, less depreciation

- BASIS Original cost of the property, and the starting point for determining gain or loss in any transaction

- BOOT Any type of property received in an exchange that is not like-kind, including cash, mortgage notes or stock CAPITAL GAIN – The difference between the property’s selling price and the adjusted basis

- DEFERRAL Payment of capital gains tax is deferred until the exchanger sells the replacement property

- EXCHANGE PERIOD Period of time allowed to acquire the replacement property in a delayed exchange or the time allowed to dispose of the relinquished property in a reverse exchange.

- IDENTIFICATION PERIOD The 45-calendar day time period within which the exchanger must identify replacement properties in the exchange.

- REALIZED GAIN Gain not yet taxed

- RECOGNIZED GAIN Amount of gain subject to tax.

- RELATED PARTY A person or entity with a relationship to the exchanger, including siblings, spouses, ancestors and descendants; a grantor or fiduciary of any trust; two corporations which are members of the same controlled group or individuals; and corporations and partnerships, if the same person owns more than 50% of the stock, capital or profits in these entities.

- RELINQUISHED PROPERTY The property exchanged of by the exchanger.

- REPLACEMENT PROPERTY The property acquired by the exchanger.

- TRANSFER TAX A tax assessed by a city, county or state on the transfer of property.