Interest rates have a much greater effect on Oahu homeowners because of our unique market. Low inventory, plus high demand, creates high levels of competition, and that pushes our home prices higher. The interest rate you pay can affect what you can afford.

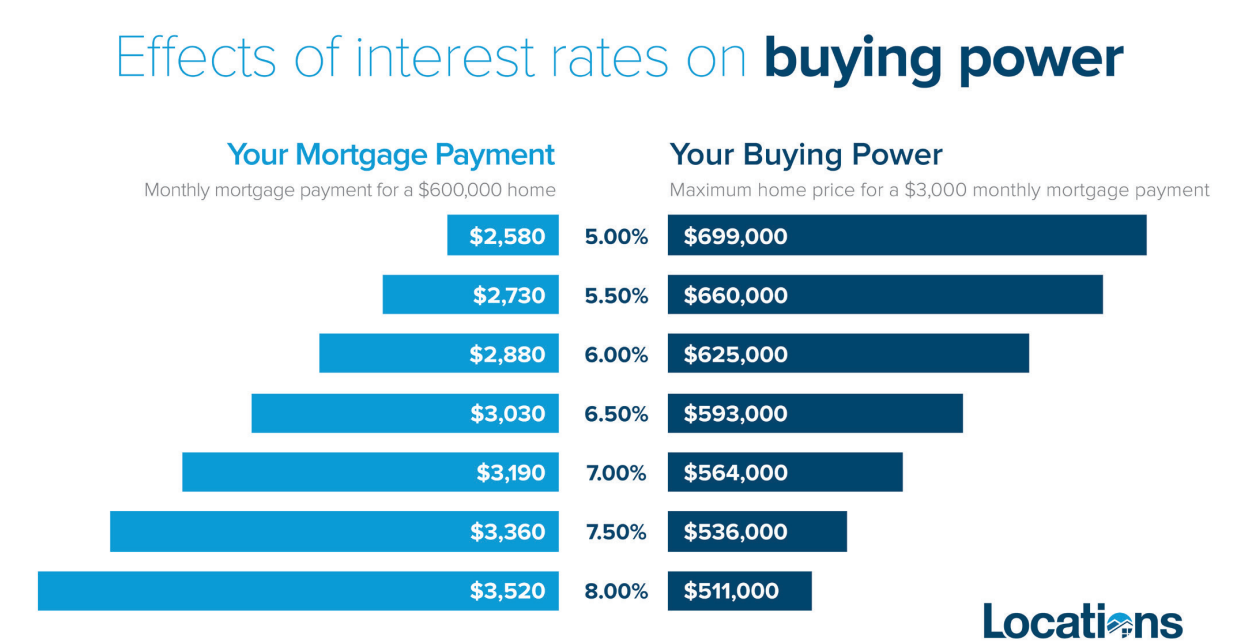

Interest rates affect monthly payments

This is where interest rates affect you the most. The higher the interest rate on your home loan, the higher your monthly payment will be. Even small increases by the Fed could affect how much you can borrow, as your loan qualification amount is based on your monthly payment in comparison to your current debt expenses. A good rule of thumb is for every 1 point interest rates increase (from 4.5% to 5.5% for example), loan payments increase by 10%.

Interest rates affect purchasing power

First-time homeowners generally feel the effects of higher interests the most. Many young individuals and families don't yet have the income level or savings to afford an increase in monthly payments. As interest rates increase, the price of the home you can qualify for decreases.